Debit the Inventory or other asset account for the value of the goods purchased and credit the Letter of Credit account for the payment issued by the bank. The company paid a 50 down payment and the balance will be paid after 60 days.

Purchase Office Supplies On Account Double Entry Bookkeeping

This journal entry eliminates the cash or credit reserved for the letter of credit and records an asset for the inventory or other resources received from the transaction.

. To record the purchase of three computers added to inventory. The AET Community. This will result in a compound journal entry.

You could also choose to record a purchase like this using three different journal entries. On December 7 the company acquired service equipment for 16000. The AET has helped more than 2 million users nationwide to manage time and financial resources both inside and outside the classroom.

There is an increase in an asset account debit Service Equipment 16000 a decrease in another asset credit Cash 8000 the amount paid and an increase. The following general address have a bit more detail particularly an inventory number assigned to each computer based on the year acquired and a.

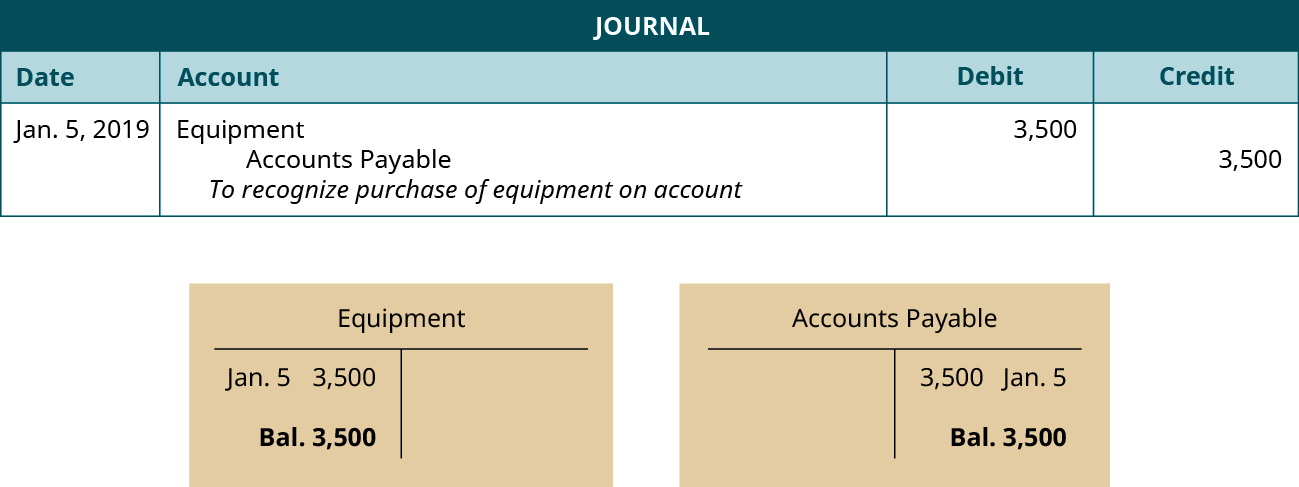

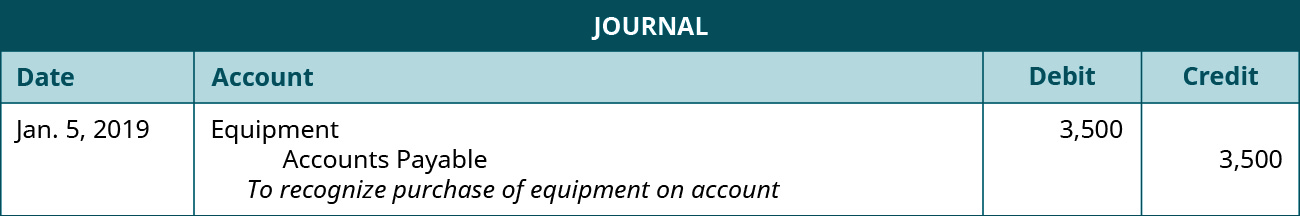

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

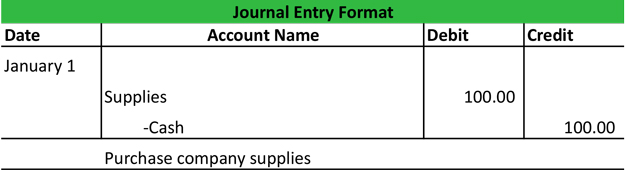

Business Events Transaction Journal Entry Format My Accounting Course

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

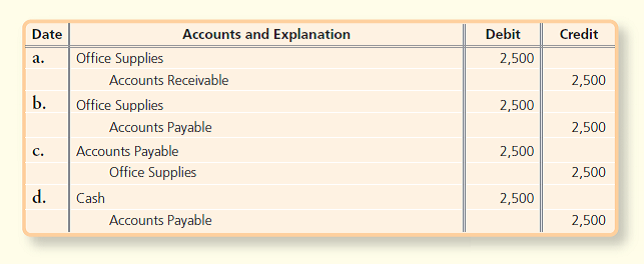

Recording Purchase Of Office Supplies On Account Journal Entry

Recording Purchase Of Office Supplies Journal Entry

Answered Date Accounts And Explanation Debit Bartleby

0 comments

Post a Comment